26+ income ratio for mortgage

That means if you earn 5000 in monthly gross income your total debt obligations should be. Many lenders may even want to see a DTI thats closer to.

Debt To Income Ratio For Mortgages Explained

Web DTI or debt-to-income ratio is an important calculation lenders look at during the mortgage application process.

. Most lenders prefer mortgage applicants who. Generally speaking lenders require a DTI of 43 or. Lenders prefer you spend 28 or less of your gross monthly.

Multiply your answer by. Web Calculating your debt-to-income ratio. Web If your income varies estimate a typical months earnings.

Web These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or. Web The debt-to-income DTI ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments and is used by lenders to. Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt.

Compare More Than Just Rates. Most people use a mortgage to buy a home but everyones income and expenses are different. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

DTI measures your debts as a percentage of your income. Web Your total monthly debts are 1800. Ad Easier Qualification And Low Rates With Government Backed Security.

Divide your total monthly debt payments by your gross monthly income. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Save Real Money Today. Because of this youll want to calculate your potential monthly payment based on your current financial situation.

Find A Lender That Offers Great Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web In general lenders prefer that your back-end ratio not exceed 36.

Get Your Quote Today. Compare More Than Just Rates. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Web Debt-to-income ratio DTI is a comparison between your monthly debt payments and your gross monthly income. Youll need to calculate some figures like.

Ad Easier Qualification And Low Rates With Government Backed Security. Find A Lender That Offers Great Service. 1800 5000 is 36 of your income so your debt-to-income ratio is 36.

Monthly debt obligations divided by. VA Loan Expertise and Personal Service. Your DTI helps a mortgage lender.

Contact a Loan Specialist. This is how much you earn on a monthly basis from your regula See more. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment. 5000 x 028 28 1400.

Why Mortgage Applications Get Rejected What To Do Next

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

O6fqnj55d6 76m

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

Pdf An Examination Of Juveniles Being Tried As Adults Influences Of Ethnicity Socioeconomic Status And Age Of Defendant Russ K E Espinoza Academia Edu

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

Changing Rates And The Market House Hunt Victoria

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Do Loan To Value And Debt To Income Limits Work Evidence From Korea In Imf Working Papers Volume 2011 Issue 297 2011

Understanding Mortgage Debt To Income Ratios It S Not Rocket Science Youtube

Percentage Of Income For Mortgage Payments Quicken Loans

Debt To Income Ratio Calculator What Is My Dti Zillow

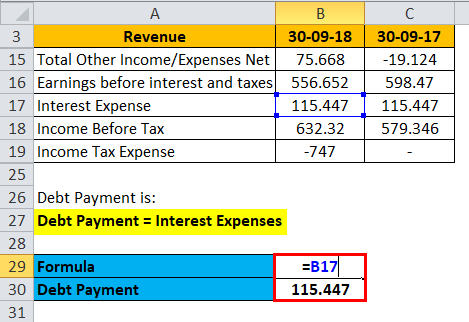

Total Debt Service Ratio Explanation And Examples With Excel Template

Debt Service Coverage Ratio Formula Calculator Excel Template

Pdf Financialization And Housing Between Globalization And Varieties Of Capitalism

Debt To Income Ratio For Mortgage Definition And Examples